Financial stress often comes from one simple problem: not knowing where your money goes each month. You might earn a decent income but still feel like you’re living paycheck to paycheck. A personal budget tracker solves this mystery by transforming vague financial anxiety into concrete data you can use to make better decisions.

The Hidden Psychology of Financial Tracking

Most people underestimate how much they spend because modern payment methods disconnect us from the reality of our purchases. Research by Australian psychologists Ken Chen and Megan Oaten found that participants who wrote down every purchase not only improved their financial lives but also developed better self-control in other areas – they smoked and drank less, ate less junk food, and became more productive at work and school.

MIT research reveals another crucial factor: people using credit cards spend more than twice as much as those using cash, with the psychological cost of spending a dollar on credit feeling like only fifty cents. Physical tracking creates what researchers call “spending friction” – a brief pause that allows you to consider whether each expense aligns with your financial goals.

Step 1: Choose Your Primary Personal Budget Tracker

Your first step involves selecting the tracker that best matches your current financial situation and primary concerns. Different life stages and financial goals require different tracking approaches.

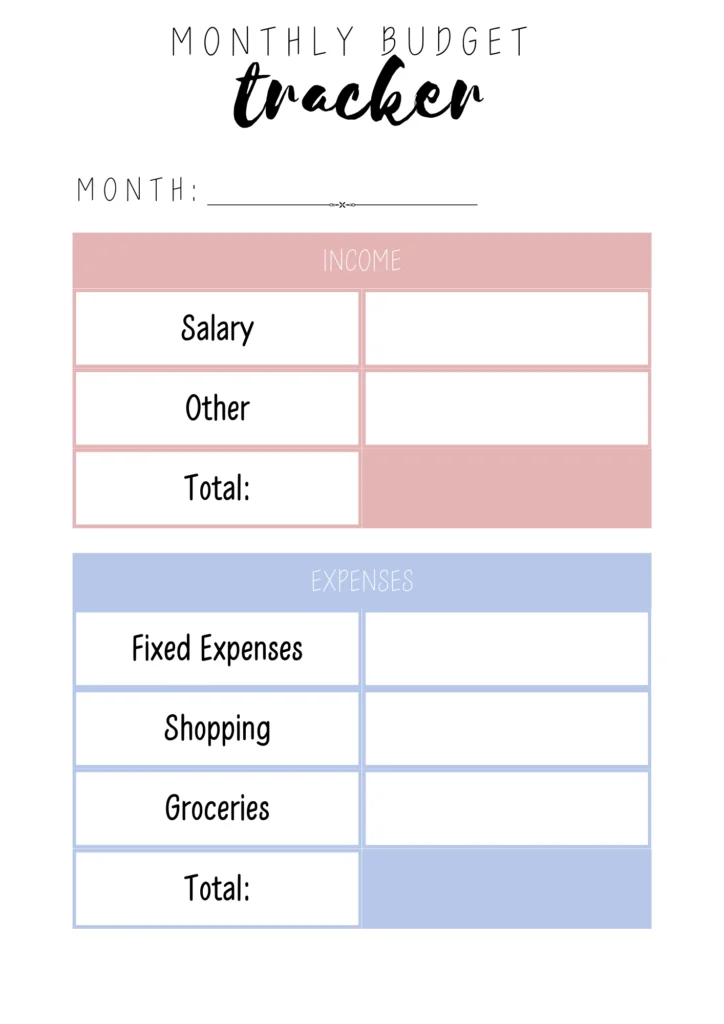

Monthly Budget Tracker for Comprehensive Planning

The monthly budget tracker provides the most complete financial picture by combining income planning with expense tracking. Use this tracker when you need to understand your overall financial health or when you’re working toward multiple financial goals simultaneously.

This tracker works best for people who receive regular paychecks and want to plan their entire month in advance. You’ll list your expected income at the top, plan your major expenses, and track actual spending throughout the month. The comparison between planned and actual amounts reveals whether your financial expectations align with reality.

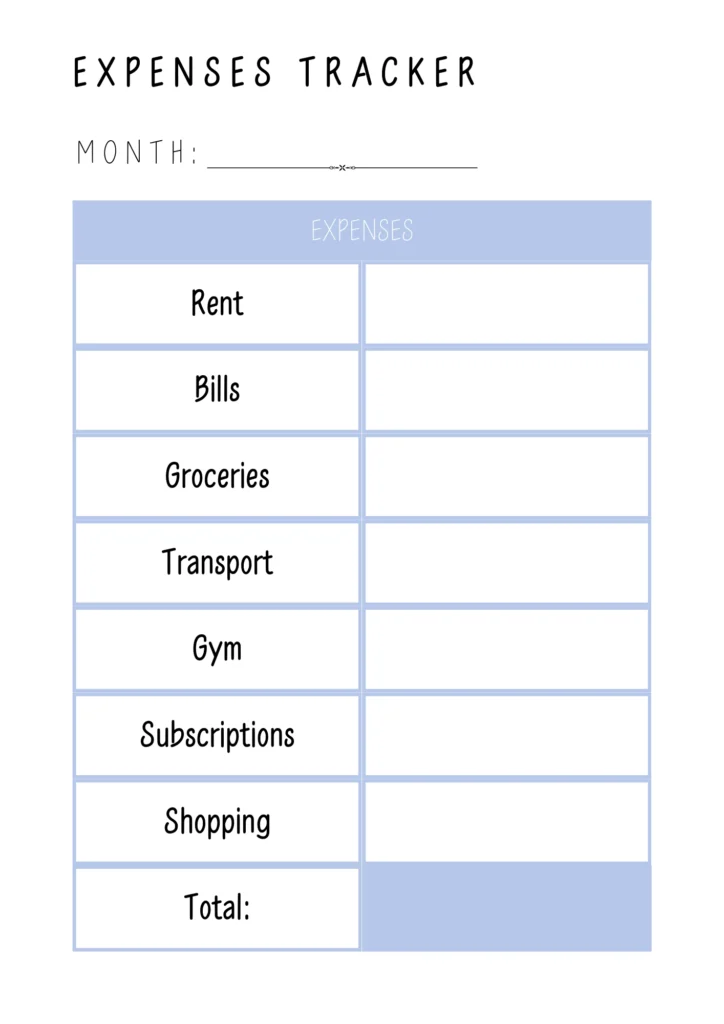

Income and Expense Tracker for Cash Flow Analysis

The income and expense tracker focuses specifically on money movement – what comes in and what goes out. This detailed approach helps you understand timing issues, irregular income patterns, and the relationship between earning and spending cycles.

Choose this tracker if you have irregular income, multiple income sources, or need to understand why you feel financially stressed despite earning decent money. The side-by-side income and expense columns make it easy to see whether you’re living within your means or slowly draining your savings.

Expense-Only Tracker for Spending Focus

The expense-only tracker eliminates income variables to focus purely on spending patterns. This targeted approach helps identify specific categories where you consistently overspend or discover forgotten subscription services and small purchases that add up significantly.

Use this tracker when you know you earn enough money but can’t figure out where it all goes. The focused format encourages detailed expense categorization without the distraction of income planning or complex calculations.

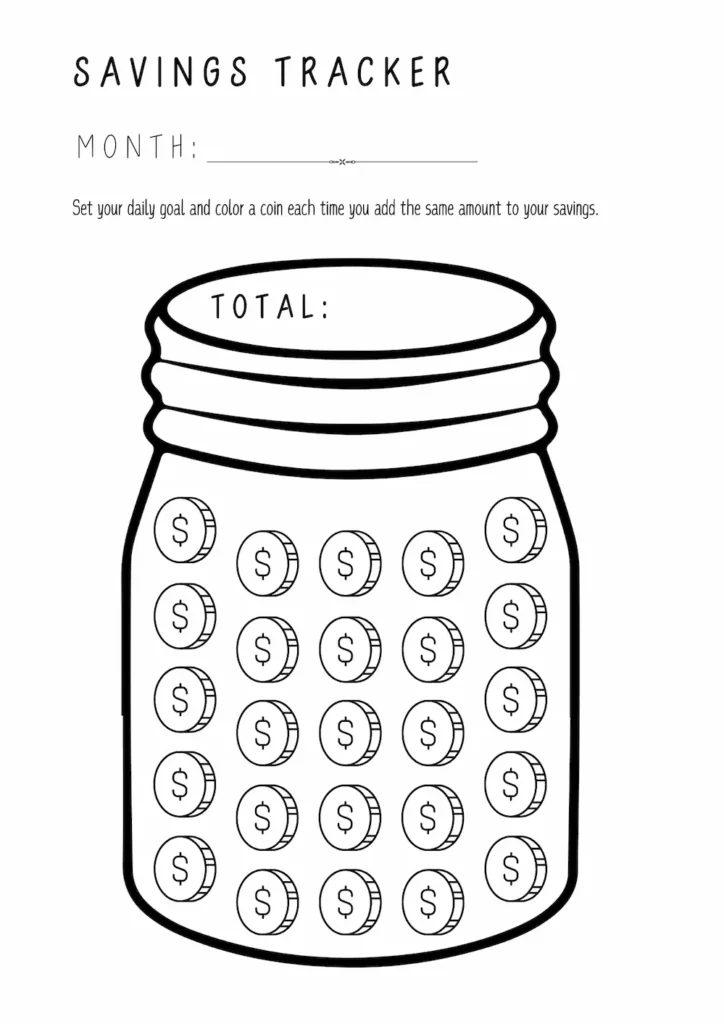

Savings Tracker for Goal Visualization

The savings tracker uses a visual jar design where you color in coins as you save toward specific goals. This playful approach transforms abstract savings targets into concrete, visual progress that maintains motivation over time.

This tracker works particularly well for people who struggle with traditional savings approaches or need extra motivation to reach financial goals. The visual element provides immediate gratification that encourages continued saving behavior.

Step 2: Set Up Your Tracking System for Success

Proper setup determines whether your personal budget tracker becomes a helpful tool or an abandoned piece of paper. These preparation steps ensure consistent use and accurate data collection.

Establish Your Tracking Schedule

Choose specific times for updating your tracker rather than trying to remember randomly throughout the day. Most successful budget trackers update their sheets either immediately after purchases, during daily coffee time, or as part of their evening routine before bed.

Daily tracking works better than weekly catch-up sessions because you’ll remember details more accurately and develop the tracking habit more quickly. However, if daily tracking feels overwhelming, start with weekly sessions and gradually increase frequency as the habit strengthens.

Create Clear Expense Categories

Develop a categorization system that makes sense for your lifestyle and spending patterns. Standard categories include housing, transportation, food, utilities, entertainment, and personal care, but customize these based on your actual spending habits.

Be specific enough to identify spending patterns but not so detailed that categorization becomes burdensome. For example, separate “dining out” from “groceries” rather than lumping everything into “food,” but don’t create separate categories for every individual restaurant unless you’re tracking a specific dining goal.

Gather Your Financial Information

Before starting your first tracking session, collect recent bank statements, credit card bills, and receipts to understand your baseline spending patterns. This historical data helps you set realistic expectations and identify categories you might otherwise forget.

Don’t aim for perfect accuracy in your first month – focus on developing the tracking habit and getting a general sense of your spending patterns. Precision improves naturally as you become more comfortable with the process.

Step 3: Execute Daily Tracking Effectively

Consistent daily tracking transforms your personal budget tracker from a static document into a dynamic financial tool. These specific techniques ensure accurate data collection and useful insights.

Record Expenses Immediately

Write down purchases as soon as possible after making them, ideally before leaving the store or restaurant. This immediate recording prevents the common problem of forgetting smaller purchases that can significantly impact your budget accuracy.

For cash purchases, keep receipts in a designated pocket or wallet compartment and transfer the information to your tracker during your established tracking time. For card purchases, use your phone to take quick photos of receipts or jot down amounts in a small notebook for later transfer.

Use Specific Amounts and Descriptions

Record exact amounts rather than rounding to the nearest dollar, and include brief descriptions that will make sense to you later. Instead of writing “food – $23,” write “lunch at Thai restaurant – $23.47.” This detail helps identify specific spending triggers and patterns over time.

Include the payment method (cash, debit, credit) to help reconcile your tracker with bank statements and understand which payment methods encourage higher spending. Many people discover they spend more when using credit cards compared to cash or debit cards.

Handle Irregular Expenses Appropriately

For monthly bills that vary (like utilities), estimate based on previous months or seasonal patterns. For completely unexpected expenses, create a separate “miscellaneous” or “unexpected” category rather than forcing them into inappropriate categories.

Don’t restart your tracker if you forget to record expenses for several days. Simply note the gap and continue tracking from your current point. These imperfections provide valuable information about when and why your tracking system breaks down.

Step 4: Analyze Your Data for Financial Insights

Raw tracking data becomes valuable only when you analyze it for patterns and insights. Weekly and monthly reviews transform your personal budget tracker into a strategic financial planning tool.

Weekly Pattern Recognition

Every Sunday, review your previous week’s spending to identify patterns related to days of the week, emotional states, or external circumstances. Many people discover they spend more on Fridays and Saturdays, during stressful periods, or when shopping with certain friends.

Look for correlations between different types of spending. Do expensive dinners out correlate with increased grocery spending the following week? Do months with high entertainment expenses also show increased transportation costs? These connections reveal how different spending categories influence each other.

Monthly Category Analysis

At month’s end, total each expense category to understand your actual spending distribution compared to your intended budget. Calculate what percentage of your income goes to each category and compare these percentages to recommended budget guidelines or your personal priorities.

Identify your top five expense categories and evaluate whether this distribution aligns with your values and goals. If 30% of your income goes to dining out but you value travel more than restaurant meals, you’ve identified a specific area for adjustment.

Trend Identification Over Time

After three months of consistent tracking, look for seasonal patterns, gradual increases in certain categories, or the impact of specific life changes on your spending. This longer-term perspective helps distinguish between temporary fluctuations and permanent shifts in your financial patterns.

Use these insights to adjust your approach for the following month. If you consistently overspend on groceries in the first week of the month, try planning smaller, more frequent shopping trips. If transportation costs spike during certain seasons, start saving extra money in advance.

Advanced Personal Budget Tracker Strategies

Once you’ve mastered basic tracking, these sophisticated techniques can enhance your financial organization and goal achievement.

Multiple Tracker Integration

Use different trackers simultaneously for related financial goals. Combine a monthly budget tracker for overall planning with a focused savings tracker for a specific goal like vacation funding or emergency fund building. This dual approach provides both comprehensive oversight and targeted motivation.

For couples, consider maintaining individual expense trackers alongside a shared monthly budget tracker. This approach respects personal spending autonomy while ensuring household financial goals stay on track.

Seasonal Budget Adjustment

Modify your tracking categories and expectations based on seasonal spending patterns. Create separate tracker versions for high-expense months (December holidays, back-to-school periods) that include additional categories and higher budgets for relevant areas.

Plan ahead for known seasonal expenses by using your savings tracker throughout the year to accumulate money for these predictable but irregular costs. This proactive approach prevents seasonal expenses from derailing your overall financial progress.

Goal Integration System

Connect each spending category in your personal budget tracker to specific financial goals. For example, reducing dining out expenses might fund your vacation savings, while lowering entertainment costs could accelerate debt payment.

Create visual connections between your expense reductions and goal progress by using the same colors or symbols across different trackers. This visual system reinforces the relationship between current spending decisions and future financial outcomes.

Troubleshooting Common Budget Tracking Challenges

Even committed budget trackers encounter obstacles that can derail their financial organization efforts. These practical solutions address the most frequent problems.

Inconsistent Tracking Habits

If you frequently forget to update your tracker, attach the tracking action to an existing strong habit. Keep your tracker next to your coffee maker and update it while your coffee brews, or place it on your nightstand and review it while brushing your teeth.

Start with tracking just one category (like dining out) until the habit becomes automatic, then gradually add other expense categories. Building tracking skills incrementally prevents overwhelm while establishing the underlying routine.

Perfectionism Paralysis

Remember that your personal budget tracker measures progress, not perfection. A tracker with some gaps that helps you reduce spending by 15% is infinitely more valuable than a perfect tracker you abandon after two weeks.

Focus on trends rather than daily precision. If your tracker shows you spent $200 more on entertainment this month compared to last month, that insight remains valuable even if you missed recording a few small purchases.

Overwhelming Financial Complexity

If your financial situation feels too complicated for simple tracking, start with just tracking expenses above $20. This approach captures the major spending patterns while avoiding the burden of recording every small purchase.

Alternatively, track just one problem category for a full month. If you suspect you’re overspending on food, track only food-related expenses until you understand those patterns completely, then expand to other categories.

Making Budget Tracking a Permanent Financial Habit

Long-term financial organization requires systems that work consistently over months and years, not just during initial motivation periods.

Monthly Tracker Rotation

Print fresh trackers at the beginning of each month as part of your monthly planning routine. Many people find that the clean slate of a new tracker provides renewed motivation and energy for financial organization.

Keep completed trackers in a binder or folder to create a visual record of your financial journey. Reviewing previous months’ trackers provides perspective on your progress and helps identify long-term patterns that monthly analysis might miss.

Quarterly Financial Reviews

Every three months, review all your completed trackers to identify larger patterns and assess progress toward annual financial goals. Use these reviews to adjust your tracking approach, modify expense categories, or shift focus to different financial priorities.

Consider this quarterly review as an opportunity to celebrate financial victories and learn from challenges rather than criticize yourself for imperfect tracking. The goal is continuous improvement, not financial perfection.

Annual Goal Evolution

Use insights from your year of budget tracking to set more realistic and specific financial goals for the following year. If tracking reveals that you consistently spend more on transportation than expected, incorporate that knowledge into next year’s budget planning.

Consider graduating to more advanced financial tools as your tracking skills improve, but maintain the core habit of regular financial monitoring. Your personal budget tracker provides the foundation for more sophisticated financial planning as your situation evolves.

Complete Collection of Personal Budget Trackers

Choose the tracking approach that matches your financial goals and personality. Each tracker serves a different purpose in your overall financial organization strategy.

| Tracker Type | Purpose | Best For | Tracking Period |

|---|---|---|---|

| Monthly Budget Tracker | Complete financial overview | Comprehensive monthly planning | 1 month |

| Income and Expense Tracker | Full financial picture | Understanding cash flow patterns | 1 month |

| Expense-Only Tracker | Focused spending analysis | Identifying spending leaks | 1 month |

| Savings Tracker | Visual savings motivation | Building emergency funds or goals | Variable |

All trackers from Plan and Simplify are designed to print clearly on regular home printers and work with any pen or pencil.

Types of Budget Trackers I Use

I’ve found that different budget trackers serve different purposes in my financial journey. That’s why I use three main types: an income and expense tracker for a comprehensive view, an expense-only tracker for focused spending analysis, and a savings tracker to visualize my progress. Each of these budget-tracking tools plays a unique role in helping me stay on top of my finances.

FAQ

Here are some common questions I’ve received about using personal budget trackers, along with my honest answers based on my own experience.

I designed these trackers to be user-friendly. They’re straightforward and don’t require any complex calculations.

In my experience, yes! Just the act of writing down your expenses makes you more aware of your spending habits, which can lead to better financial decisions.

Begin with the expense-only tracker if you’re new to financial tracking. This focused approach helps you understand your spending patterns without the complexity of income planning or goal setting.

Start with one tracker today, choose one specific financial goal, and make your first entry. Plan and Simplify budget trackers work best when you begin immediately rather than waiting for the “perfect” financial moment. Download your chosen tracker now and take the first step toward complete financial organization.